Financial Madness

When does an economy go from being a synergy in society to be parasitic? When does the financial economy transform into financial madness?

Investors and lending institutions can have a prosperous function when money is lent to new or growing companies. Hence, they can contribute to innovation, production, and employment, which are driving factors for a healthy economy. They can also provide loans to establishing home buyers and to development of housing markets. Nevertheless, in certain epochs, and especially the last decades, banks and financial institutions have had other intentions than entering such apparent win-win relationships.

Several news headlines claim that the financial crisis from 2008 now is over. The Norwegian authors Helge Hveem (et al.) who has written the book “Global Economy, Crisis and Political Management” answers such pronouncements with: “The crisis over in a world where several countries have youth unemployment of around 50% and total unemployment of more than 20%?”. Media often refer to the mere access to credit, but yet overlooks what adds value for societies and developing over time. The long-term effect of ever-growing state debt is also overlooked.

When an economy transfers from creating value through products and services to be about increasing the national money supply, continuous debt increase or enrichment through pyramid games, the outcome is bad without exception.

According to economy professor Erik Reinert in the think tank Res Publica the fundamental problem with financial crises is the failure to distinguish between the financial economy and the real economy. While real economy relates to creating value through services and production, i.e. “real work”, the financial economy is about the exchange medium and the abstract framework around it. Reinert requests an economy that is more reality-oriented, versus the reality distant tradition.

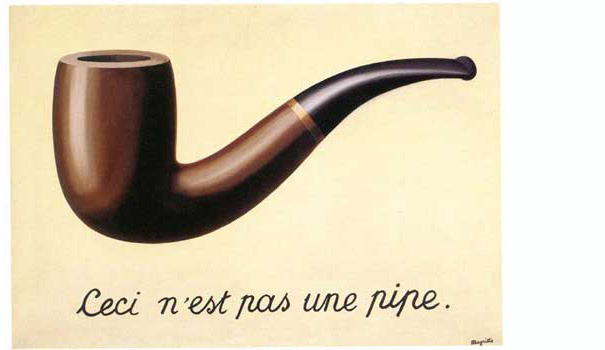

“This is not a pipe”, is the title of Rene Magritte’s painting from 1929. His surrealistic point was that the observer needs to distinguish between a visual concept versus what is physically present, regardless of its visual realism. The same principle should economists, politicians – and ultimately the citizens – also follow. Financial economics, as with some theoretical subjects, are often less related to clearly measurable matters and more about concepts and abstract quantities. Thus, it is not incomprehensible that people struggle to get a grasp of this – and perhaps that is the purpose.

The Chairman of Nordea (one of the largest financial institutions in Scandinavia), Björn Wahlroos stated [in 2015] that 80 percent of people are financial idiots. While he may have his reasons to claim this, one needs to question why such a tendency could be the case. It is also convenient that private banks and lending institutions sends tonnes of tempting consumer loans to people’s postboxes and produces lofty TV and radio commercials of the same kind. Through ordinary schooling, people aren’t armed well enough against financial traps, and they therefore easily become victims. It should be obvious who gains from this tendency.

One can then point out that during financial crises one witness a rather unsober relation to the economy also among the establishment. Such scenarios were covered among others by Norwegian economist Hans Jørgen Lysglimt through several clips as the financial crisis and bail-outs went on in 2008. Evidently, the institutions and people that are entrusted to manage money are not always to be trusted.

The documentary “When The Bubbles Burst” explains the financial casino game that had its origin in the declining real estate market in the US, reckless banking policies and trading of camouflaged rotten funds. Here, investor Øystein Spetalen states that the billion-dollar fraud was, for politicians and ordinary people alike, completely incomprehensible as rating companies and finance institutions played on the same team. Thus, people’s savings, banks, municipalities and eventually whole nations took the hit when almost worthless concepts were revealed.

The Norwegian “Terra case” which has gone on since 2007 illustrates the problem. These municipalities had a relatively good economy based on revenue from electricity and production. Terra Securities (on behalf of Citigroup) recommended investing in their “virtually risk-free” structured products using future revenues as security. The transition from a healthy production economy to speculative finance economy caused losses in the order of billions, which keep haunting these municipalities. In other words, the focus was shifted from boring reality based revenue to exciting castles in the air.

“The Great Mirror of Folly” is a Dutch collection of satirical prints, plays, and commentary related to finance, culture and bubbles in Europe. The book covers the folly of people convinced about illusions of getting rich fast, pyramid schemes from men in suits and what became a distancing from real values. This book was published in 1720 and was meant as a warning to coming generations but is likely unknown for most people today.

In the Hollywood movie “Wall Street” (1987) Michael Douglas pronounces the well-known words “Greed is good”. The point is that the eagerness of achieving wealth will induce innovation, production, and progress. This greed and eagerness will just as often induce speculative and unproductive mechanisms, hereby creating bubbles and pyramid schemes, where the latest participants lured into the game become losers.

Those who lose out are often future generations that literally inherit the bill through deeper national indebtedness and cuts in welfare budgets. The reason being that the production economy doesn’t match the committed obligations to the financial economy.

A mutated form of capitalism enables profit to be privatized while losses often are nationalized to the people. If this was the case for Las Vegas’ casinos, few would have believed it.

Another problem with financial crises is that in its aftermath there is a gradual shift of power and longterm expenses that in the end is inflicted upon the people. The measures for restoring the economy usually means transferring money to the banking and financial sector (in order to maintain liquidity and continued lending) and seldom involves plans for developing industry and innovation. As a professor of political economy Andreas Bieler has criticized (translated):

“In summary, employers in the whole EU exploit the crisis in order to reverse the post-war progress and achievements of the workers’ movement. The crisis gives [companies] a justification of cuts they otherwise wouldn’t have been able to implement.”

An important part of the solution is therefore that people become familiar with the madness and mechanisms that have occurred in waves over decades (and centuries). If the topics become a part of the syllabus of ordinary education, a better economical consciousness will be obtained among those who will enter future positions and governments.

From a political stance, the focus should to a larger extent be on understanding capital through physical and real values, where the purpose is to build, manufacture, employ and maintain in accordance with contemporary and future needs. Placing capital in speculative forms – which can increase or decrease its abstract value – has more in common with gambling and does often transfer huge amounts to unproductive sectors.

The aim for a national economy must be to establish infrastructures that work as a properly configured circuit board, without leaks or short circuits. Finance economy can contribute to the framework and tools for optimal liquidity, but should never be disproportional in regards to the production economy – nor should it be allowed to fabricate pyramid schemes. It the latter cases it is historically proven that the economy changes from having a synergy role to become parasitic onto the society. The greed and eagerness to get rich fast seem to unleash financial madness.